Is Singapore’s digital banking truly accessible to everyone?

As In Singapore, banking is going digital at an unprecedented pace. Mobile apps are no longer a “nice to have”, they’ve become the primary gateway for customers to access and manage their finances. Yet, with this rapid transformation, one question looms large: are these digital services truly accessible to everyone?

Written by Kevin Huang

By 2030, nearly one in four Singaporeans (25%) will be aged 65 or above. According to The Straits Times, 70% of seniors said they have been banking online frequently since the start of the pandemic. At the same time, Singapore’s digital transformation continues to accelerate. The government actively encourages citizens to embrace digital-first payments, from CDC vouchers to PayNow via mobile banking apps, making online financial services an essential part of everyday life. This is why digital accessibility must be seen not as a compliance exercise, but as a growth strategy. By building platforms that serve the full spectrum of users, financial institutions can unlock millions of underserved customers turning exclusion into inclusion, and friction into revenue.

When digitalisation leaves people behind

As banks in Singapore push toward digitalisation by closing branches, reducing counter services, and automating more processes, many seniors are feeling marginalised or left behind. While banks have introduced initiatives such as training workshops and simplified app interfaces, many older users continue to struggle due to unfamiliarity, fear of scams, low confidence, or a preference for human interaction.

For visually impaired individuals, the stakes are even higher. CNA found that many express fear of making costly errors when transferring money or paying bills. Others worry about falling victim to scams because screen readers sometimes misinterpret crucial details.

These concerns are not unfounded. In 2023, fraud cases linked to digital banking resulted in S$13.7 million in losses. While not all were directly caused by accessibility issues, the overlap is clear: when digital systems are not designed to enable users, users become more vulnerable to exploitation.

And the losses don’t stop there. Inaccessible services create a silent churn problem:

Customers abandon apps they cannot use.

Accounts go dormant.

Lifetime customer value erodes.

Each abandoned app represents more than a failed interaction, it signifies lost deposits, fewer transactions, and diminished trust. Over time, these factors compound into measurable revenue leakage.

One step forward: the case of OCBC digital silvers

During its Digital Silvers workshops, OCBC identified that many senior users faced challenges with the app’s visibility and usability. Participants frequently squinted at their screens and expressed concern about tapping the wrong buttons. Adjusting font sizes through their phone settings often had little effect, or in some cases, disrupted the app’s layout, according to OCBC head of global consumer financial services.

With almost 40% of OCBC’s digitally active customers aged 60 and above, the bank recognised the need for a more inclusive experience. In response, it rolled out smart text resizing in both English and Mandarin, allowing on-screen content to be more readable and improving usability for users with visual impairments.

While this feature represents a meaningful first step toward inclusion, further improvements are still needed to achieve comprehensive accessibility across the platform.

Persistent barriers in digital banking are opportunities for growth

A 2023 study by the Singapore Institute of Technology (SIT) highlighted several common accessibility barriers in banking apps:

One-Time Passwords (OTPs) delivered only by SMS, which can be inaccessible to users relying on assistive devices.

Low-contrast text, which fails visibility standards and poses challenges for visually impaired users.

Complex navigation, which increases error rates and user abandonment.

Accessibility is the foundation for trust, the most valuable currency in banking. Customers who feel confident using an app are more likely to deposit, transact, and recommend your services. Trust, once broken through poor usability or exclusion, is difficult to rebuild. In short, accessibility is not a cost centre, it is an investment in growth, loyalty, and long-term profitability.

Embedding accessibility by design

At PSYKHE, we believe accessibility should be systematic, not situational. It's most effective embedded from the ground up. We align our work with the four core principles of accessibility defined by the Web Content Accessibility Guidelines (WCAG):

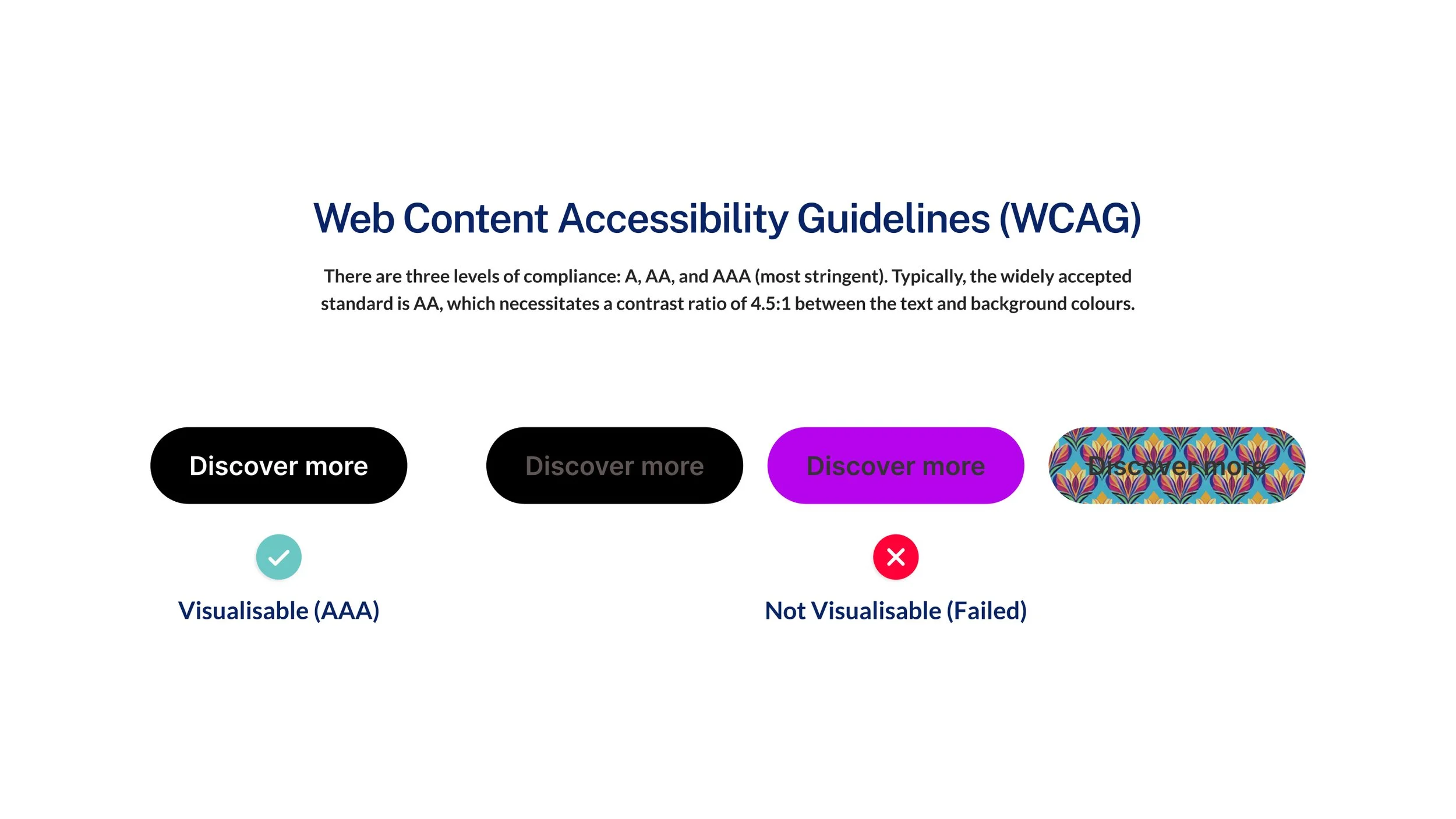

1. Perceivable – Information must be presented in ways users can see, hear, or otherwise perceive

Ensure colour choices have sufficient contrast, so that even users with impaired vision can see them easily.

2. Operable – Interfaces must be navigable by mouse, keyboard, or assistive technologies

Optimise your website for compatibility with assistive devices and keyboard control.

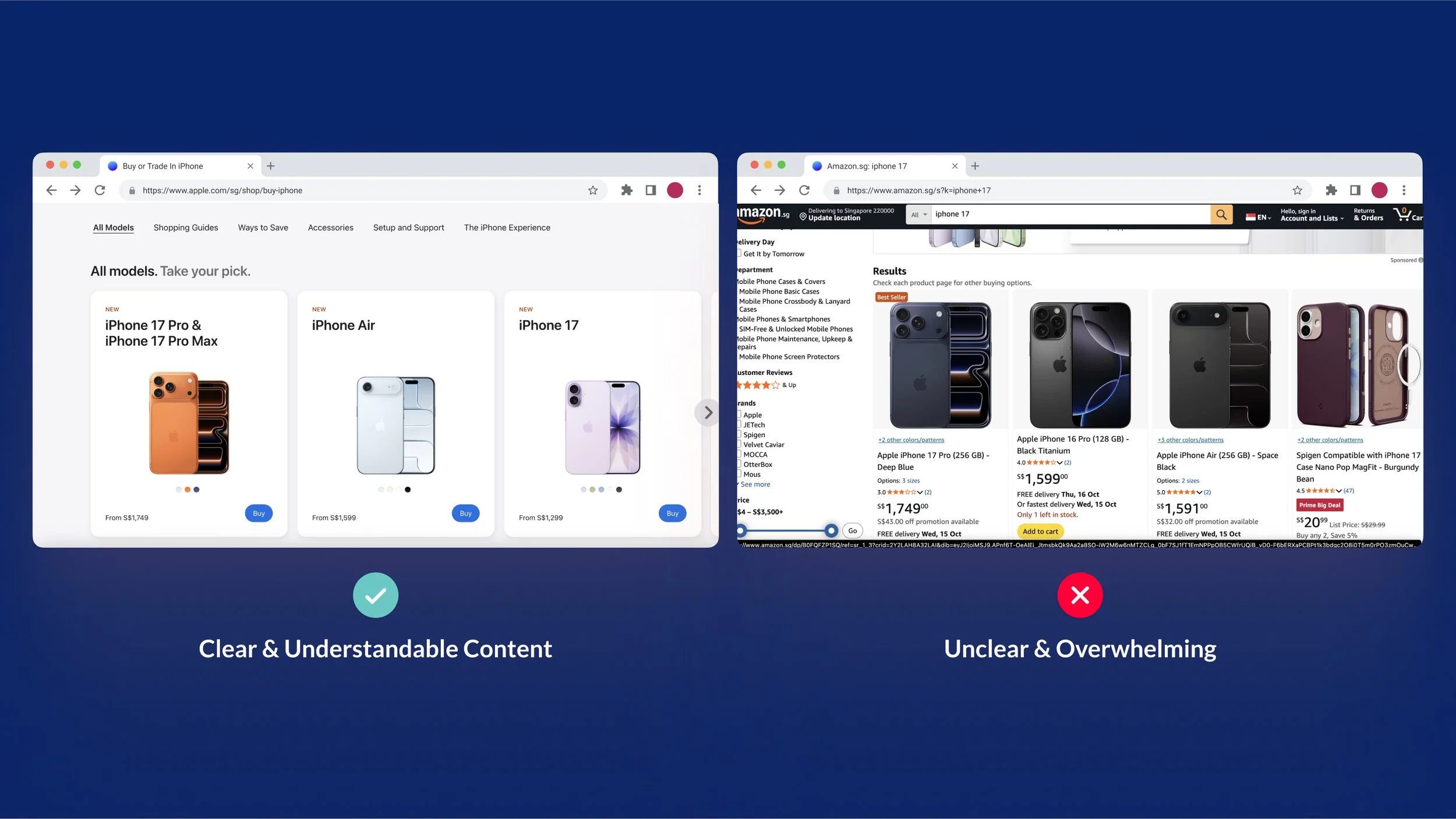

3. Understandable – Content and interactions must be clear, consistent, and predictable

Content should be simple and easy for users to understand.

4. Robust – Systems must remain accessible as technologies and assistive tools evolve

Convert text to speech to support people with dyslexia, those who have difficulty reading, and individuals who prefer to multitask.

Rooted in these four principles, accessibility is one of the six pillars in PSYKHE’s proprietary Digital Experience Audit framework, a heuristic model that aggregates and adds on to expert guidelines such as Nielsen Norman’s 10 usability heuristics and Singapore’s government accessibility standards. We apply this framework to our clients' digital experiences to assess accessibility, usability and visual design. At the end, clients walk away with a comprehensive scorecard that highlights their strengths, areas for improvement, and actionable recommendations for growth.

How we bring accessibility to life

For accessibility work with our fsi clients, our design methodology tackles accessibility using a 3 prong approach:

Design Systems – We build accessible design systems that ensure consistency in colour contrast, typography, and component behaviour, making accessibility scalable across products.

Digital Experience Audit – We evaluate digital platforms through our six-pillar heuristic framework to identify usability and accessibility gaps.

UX Strategy – We align accessibility with business goals, ensuring that inclusive design supports both user satisfaction and commercial outcomes.

This holistic approach transforms accessibility from a one-time compliance task into a lasting competitive advantage. By embedding accessibility “by design” rather than as an afterthought, we enable financial services and other industries to deliver products that are inclusive, compliant, and commercially successful.

Exclusion is expensive. Inclusion is profitable. Are your digital banking services ready for everyone?